child care tax credit schedule

Web The Employer-Provided Child Care Facilities and Services credit allows businesses to receive a valuable tax credit of 25 of related child care expenses and 10 of their. Web Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit.

American Rescue Plan Act Of 2021 New 3rd Stimulus Chart Child Related Tax Credits Cobra Dependent Care Fsa Limits My Money Blog

Web To reconcile advance payments on your 2021 return.

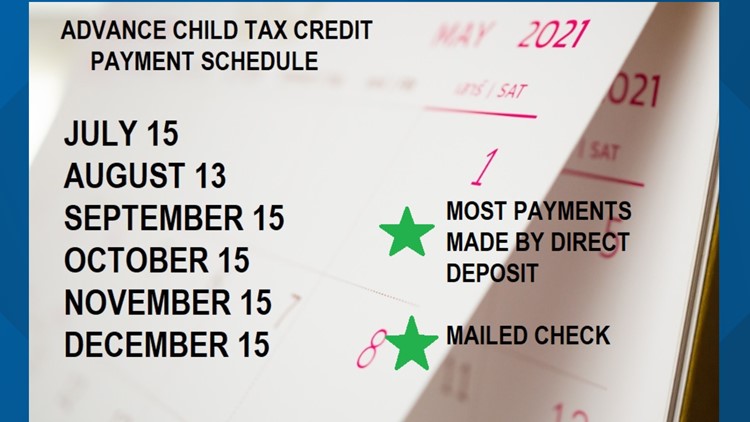

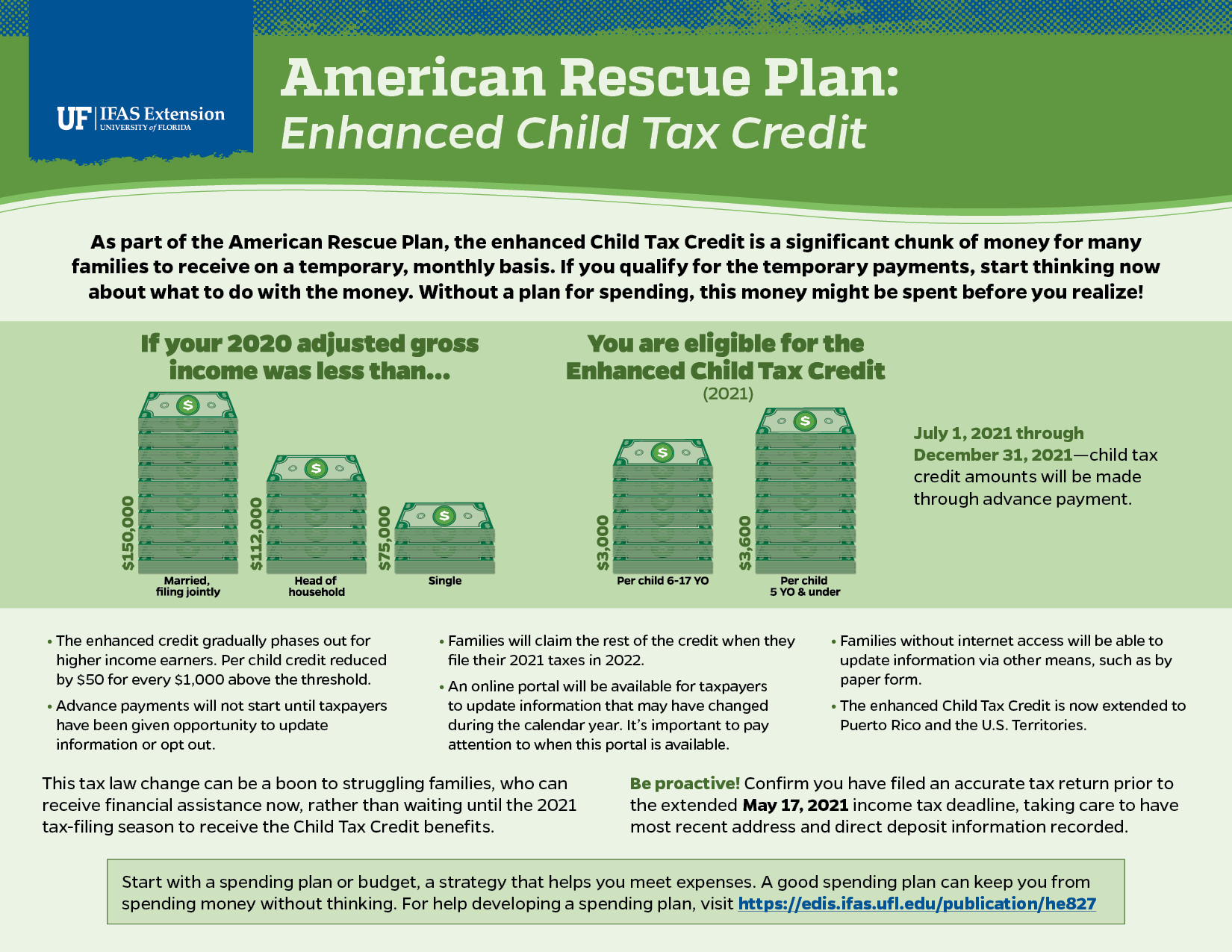

. File Schedule ELC and Schedule S Supplemental Information and Dependents. If you have at least one qualifying child. Web Under the American Rescue Plan each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17.

Web You will need the following information if you plan to claim the credit. Web To qualify one of these must apply. Web For 2021 the credit figured on Form 2441 Child and Dependent Care Expenses line 9a is unavailable for any taxpayer with adjusted gross income over 438000.

The form asks for your care-related expenses for the. 15 opt out by Aug. Web Parents with children aged 17 years or under are mostly eligible for the new child tax credit.

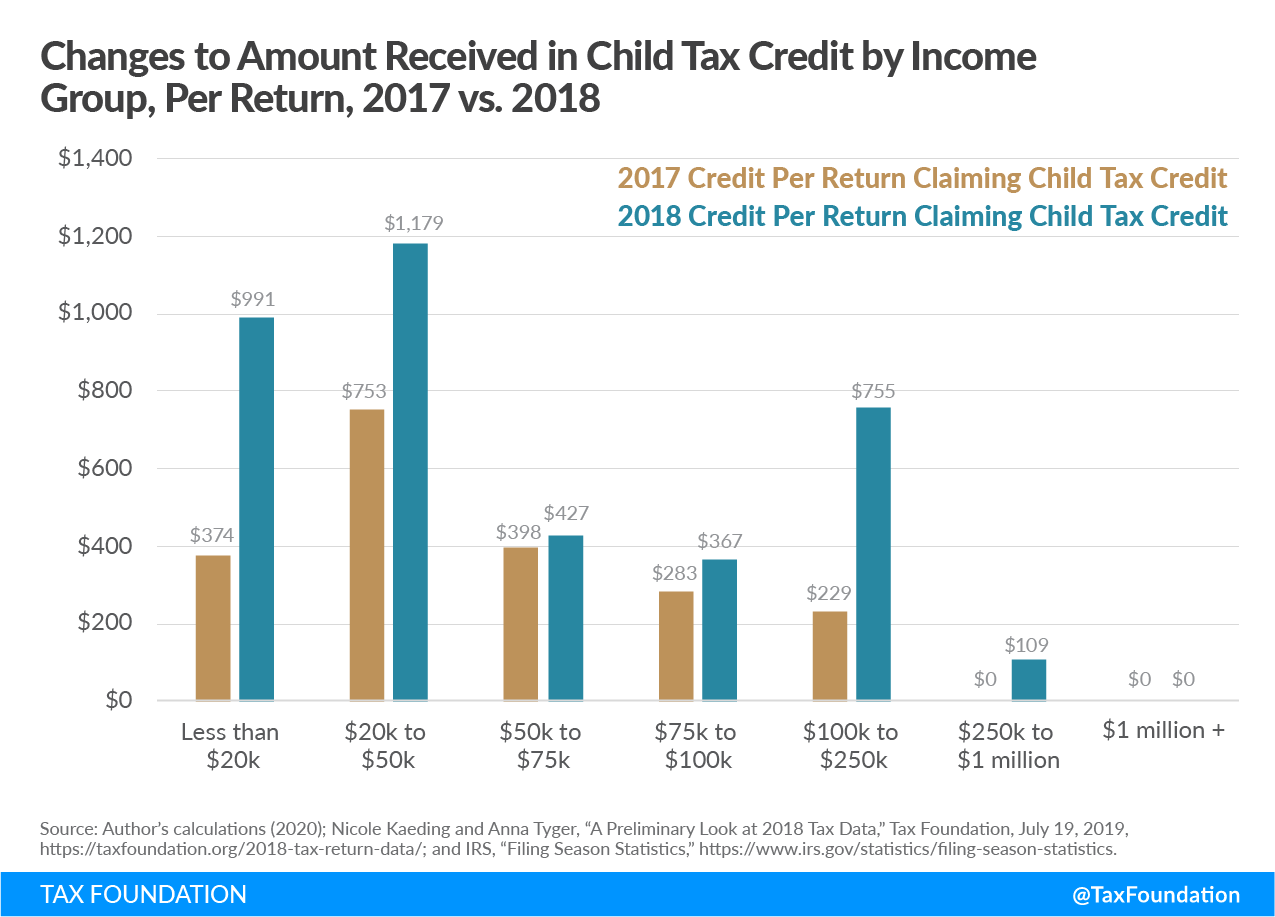

Cash receipts received at the time of payment that can. Web For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger. Your earned income must be more than 2500 for 2019.

You must have three or more qualifying children. Web The Ontario Child Care Tax Credit supports families with incomes up to 150000 particularly those with low and moderate incomes. Web To claim the child and dependent care credit you must also complete and attach Form 2441 Child and Dependent Care Expenses.

Web Unless Congress takes action the 2020 tax credit rules apply in 2022. Web You will need to file IRS Form 2441 with your personal federal income tax return in order to claim the child care tax credit. Web For 2021 the American Rescue Plan Act of 2021 enacted March 11 2021 made the credit substantially more generous up to 4000 for one qualifying person and.

The maximum child tax credit amount will decrease in 2022. Web The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. The Instructions for Form 2441.

13 opt out by Aug. Get your advance payments total and number of qualifying children in your online account. Learn how the credit is calculated.

1200 in April 2020. Canceled checks or money orders. Web In order to claim the Keep Child Care Affordable Tax Credit you must complete the following.

Parents with children aged 5 and younger can qualify for a 300 monthly. Web Thanks to the American Rescue Plan for this year only families can receive a Child and Dependent Care Credit worth. Web The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible.

Heres an overview of what to know. Web However the basic starting point is that you get up to 3000 for one dependent and up to 6000 for having multiple dependents in dependent care. You do not get that full amount.

Up to 4000 for one qualifying person for example a.

Child Care Contribution Tax Credit The Family Center La Familia

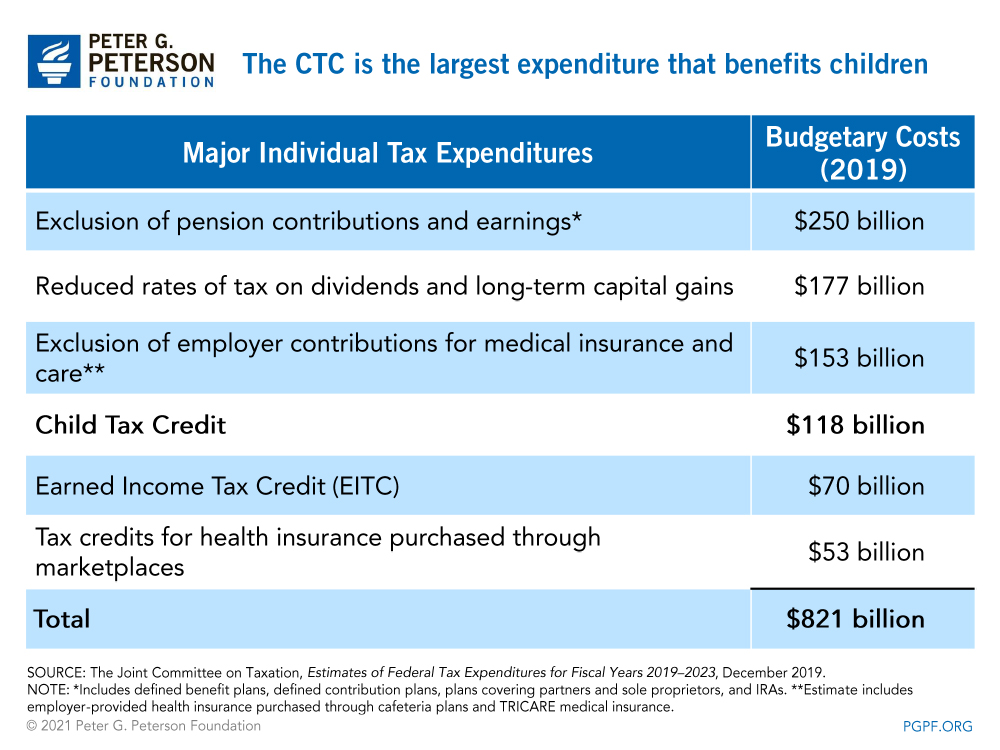

Fixing The Child Care Tax Credit Eoprtf Cclp

Child And Dependent Care Expense Credit For Tax Year 2022

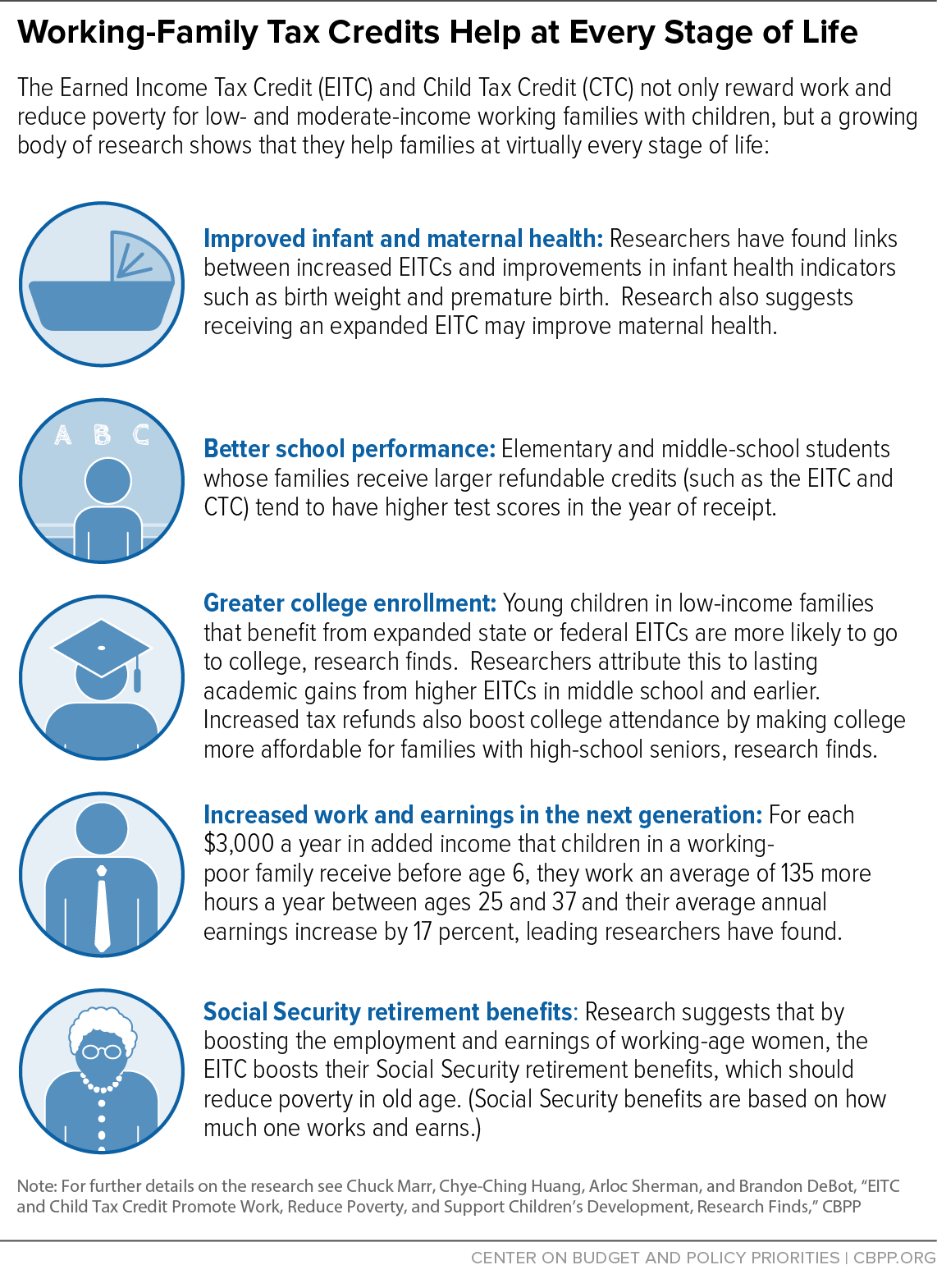

Chart Book The Earned Income Tax Credit And Child Tax Credit Center On Budget And Policy Priorities

Biden S Child Tax Credits Quietly Underwrite Family Expenses Whyy

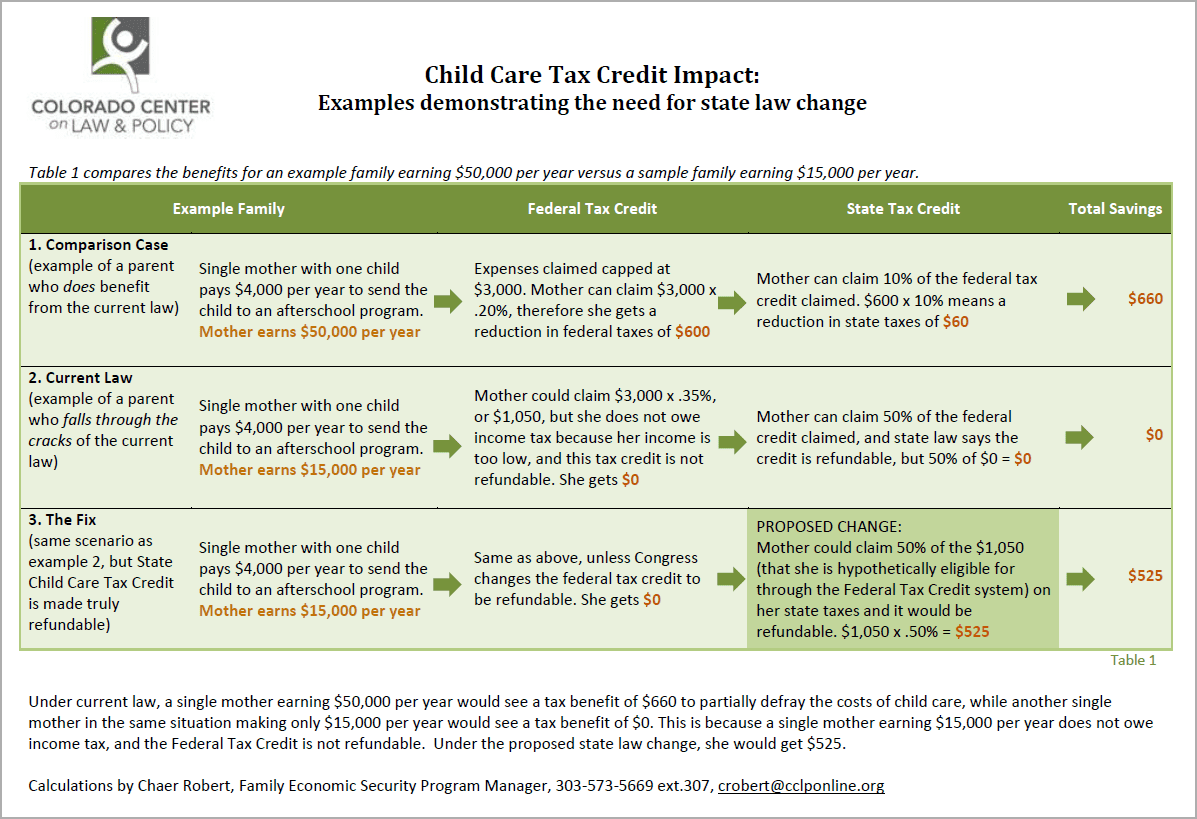

The Child Tax Credit Research Analysis Learn More About The Ctc

Q A With Lattaharris Llp Child Tax Care Credit City Of Washington Iowa

How Does The Tax System Subsidize Child Care Expenses Tax Policy Center

1040 Schedule 3 Drake18 And Drake19

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

New Child Tax Credit Takes Effect In Pennsylvania 90 5 Wesa

:max_bytes(150000):strip_icc()/IRSForm24412-76e295ec60f541aa91f6fe9494b03057.jpg)

Irs Form 2441 What It Is Who Can File And How To Fill It Out

The New Child Tax Credit Does More Than Just Cut Poverty

How To Apply For The Connecticut Child Tax Rebate Before The Deadline Sunday Connecticut Public

How To Claim The Child Tax Credit Up To 8 000 For Child Care Expenses Nextadvisor With Time

American Rescue Plan Enhanced Child Tax Credit Living Well In The Panhandle